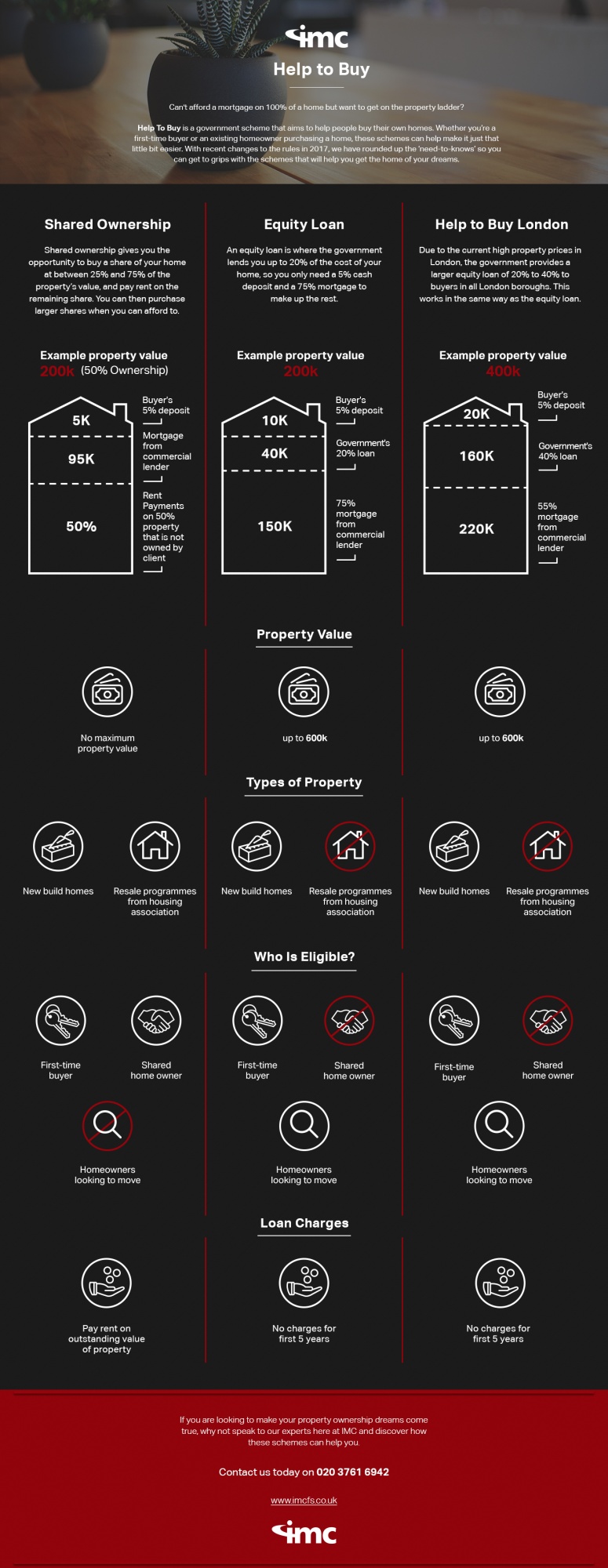

Looking for help with buying your home? Help To Buy is a government scheme that aims to help people buy their own home. We know these schemes can seem overwhelming and it can be hard to understand how they could work for you, so we have put our experts minds together so you can get to grips with how they can help you buy your own home in this simple infographic.